Understanding the $88 USD to AUD Exchange Rate: A Comprehensive Guide

Navigating the world of currency exchange can often feel like a complex puzzle. Many factors influence the value of one currency against another, and keeping abreast of these fluctuations is crucial for anyone involved in international transactions, travel, or investment. This article provides a comprehensive overview of the exchange rate between the United States Dollar (USD) and the Australian Dollar (AUD), specifically focusing on the conversion of $88 USD to AUD. We’ll delve into the current exchange rate, the factors that influence it, historical trends, and practical implications for various scenarios.

Current $88 USD to AUD Exchange Rate

As of today, the exchange rate between USD and AUD fluctuates continuously. To get the most accurate and up-to-date conversion of $88 USD to AUD, it’s essential to consult a reliable currency converter or financial website. These platforms provide real-time exchange rates that reflect the latest market conditions.

For illustrative purposes, let’s assume the current exchange rate is 1 USD = 1.50 AUD. In this case, $88 USD would be equivalent to $88 * 1.50 = $132 AUD. However, this is merely an example; the actual exchange rate will vary. Always check a live currency converter before making any financial decisions.

Factors Influencing the USD to AUD Exchange Rate

Several key factors determine the exchange rate between the USD and AUD. Understanding these factors can provide insights into why the rate fluctuates and help you make informed decisions regarding currency exchange.

Economic Indicators

Economic indicators play a significant role in influencing currency values. These indicators include:

- Gross Domestic Product (GDP): A country’s GDP growth reflects its economic health. Strong GDP growth typically strengthens a currency.

- Inflation Rate: High inflation can weaken a currency as it erodes purchasing power. Central banks often adjust interest rates to manage inflation.

- Unemployment Rate: A low unemployment rate indicates a healthy economy, which can boost a currency’s value.

- Trade Balance: A trade surplus (exports exceeding imports) generally strengthens a currency, while a trade deficit can weaken it.

Interest Rates

Interest rates set by central banks, such as the Federal Reserve in the US and the Reserve Bank of Australia (RBA), significantly impact exchange rates. Higher interest rates tend to attract foreign investment, increasing demand for the currency and driving up its value. Conversely, lower interest rates can make a currency less attractive to investors.

Geopolitical Events

Geopolitical events, such as political instability, wars, or trade disputes, can create uncertainty and volatility in currency markets. Investors often seek safe-haven currencies during times of crisis, which can affect the relative value of currencies like the USD and AUD.

Commodity Prices

Australia is a major exporter of commodities, including iron ore, coal, and natural gas. Fluctuations in commodity prices can significantly impact the Australian Dollar. For example, an increase in the price of iron ore can boost the AUD’s value, while a decrease can weaken it.

Market Sentiment

Market sentiment, or the overall attitude of investors towards a currency, can also influence exchange rates. Positive sentiment can drive up demand for a currency, while negative sentiment can lead to a sell-off.

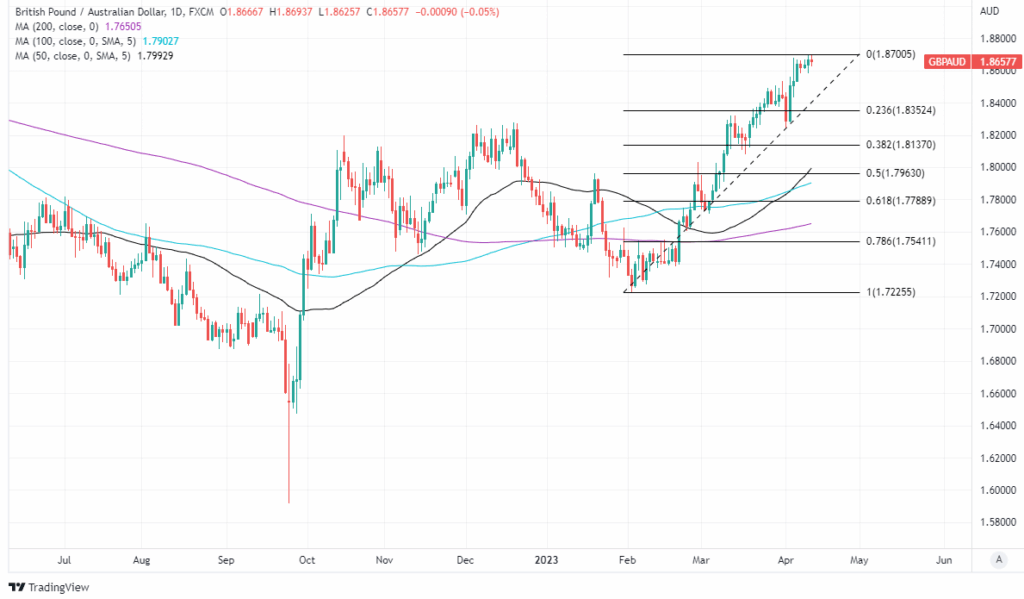

Historical Trends of USD to AUD Exchange Rate

The USD to AUD exchange rate has experienced significant fluctuations over the years. Analyzing historical trends can provide valuable context for understanding current market conditions. For instance, during periods of global economic uncertainty, the USD, often considered a safe-haven currency, may strengthen against the AUD. Conversely, during periods of strong global growth and high commodity prices, the AUD may outperform the USD.

Reviewing historical charts and data can help identify patterns and potential future movements in the exchange rate. However, it’s important to remember that past performance is not necessarily indicative of future results.

Practical Implications of Converting $88 USD to AUD

Understanding the conversion of $88 USD to AUD has various practical implications, depending on your specific circumstances.

Travel

If you’re traveling from the US to Australia, knowing the exchange rate is crucial for budgeting your trip. Converting $88 USD to AUD will give you an idea of how much spending money you’ll have in Australian dollars. Keep in mind that banks and currency exchange services may charge fees or commissions, so factor those into your calculations.

Online Shopping

Many online retailers offer products in both USD and AUD. When making purchases from Australian websites, it’s essential to understand the exchange rate to accurately assess the cost of the items. Consider using a credit card that doesn’t charge foreign transaction fees to minimize expenses.

Investments

If you’re investing in Australian assets or securities, the USD to AUD exchange rate will impact your returns. A stronger AUD will increase the value of your investments when converted back to USD, while a weaker AUD will decrease their value. It’s important to consider currency risk when making international investments.

Remittances

Individuals sending money from the US to Australia need to be aware of the exchange rate to ensure the recipient receives the intended amount. Compare exchange rates and fees from different money transfer services to find the most cost-effective option.

Tips for Getting the Best Exchange Rate

Here are some tips to help you get the best possible exchange rate when converting $88 USD to AUD:

- Compare Exchange Rates: Check exchange rates from multiple sources, including banks, currency exchange services, and online platforms.

- Avoid Airport Exchange Services: Airport exchange services typically offer less favorable exchange rates due to high overhead costs.

- Use a Credit Card with No Foreign Transaction Fees: Some credit cards don’t charge foreign transaction fees, which can save you money on international transactions.

- Consider a Prepaid Travel Card: Prepaid travel cards allow you to lock in an exchange rate before your trip, protecting you from fluctuations in the market.

- Monitor the Market: Keep an eye on the USD to AUD exchange rate and make your conversion when the rate is favorable.

Conclusion

Converting $88 USD to AUD involves understanding the current exchange rate and the various factors that influence it. By staying informed about economic indicators, interest rates, geopolitical events, and market sentiment, you can make more informed decisions regarding currency exchange. Whether you’re traveling, shopping online, investing, or sending money, understanding the USD to AUD exchange rate is essential for managing your finances effectively. Always consult a reliable currency converter for the most accurate and up-to-date information. Remember that the value of $88 USD in AUD is subject to change, so continuous monitoring is key. [See also: Investing in the Australian Stock Market] [See also: Understanding Currency Exchange Rates] [See also: Best Time to Exchange USD to AUD]