Unlocking Value: A Comprehensive Guide to Stock Albums and Investment Strategies

In the realm of financial investments, the term “stock album” might conjure images of meticulously organized physical collections of stock certificates from bygone eras. While these historical artifacts hold sentimental and collector’s value, the modern interpretation of a stock album encompasses a broader, more dynamic investment strategy. This article delves into the multifaceted world of stock albums, exploring their evolution, the various approaches to creating and managing them, and the potential benefits and risks involved.

The Evolution of the Stock Album Concept

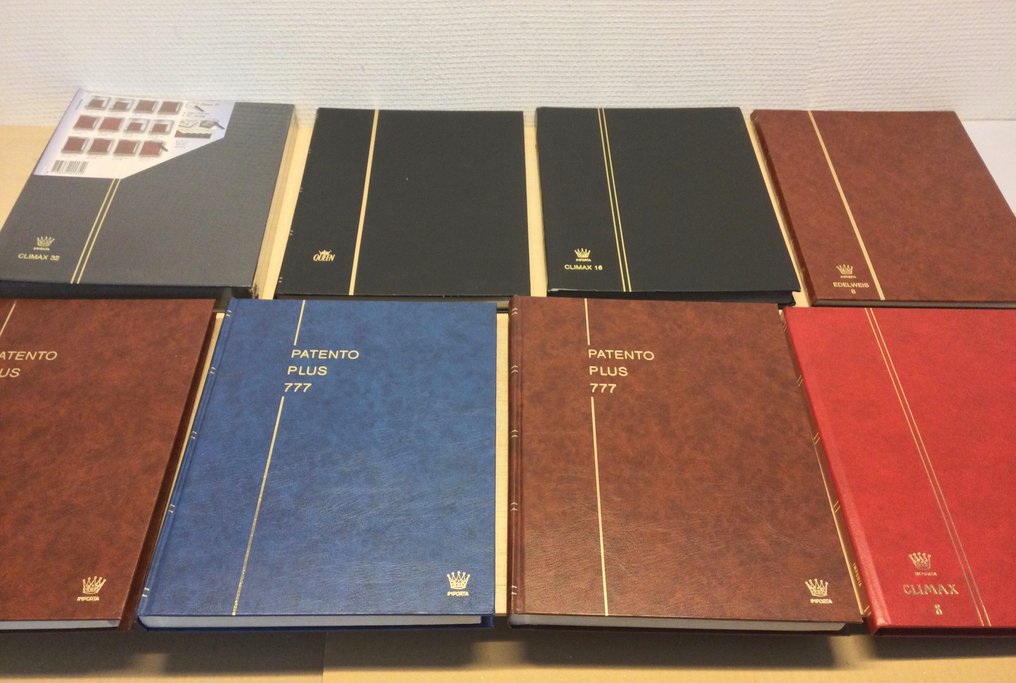

Historically, a stock album referred to a physical binder or collection where individuals stored their stock certificates. These tangible reminders of ownership were common before the widespread adoption of electronic record-keeping and online brokerage accounts. Today, the concept has transitioned to represent a curated portfolio of stocks, often with a specific theme, sector focus, or investment objective.

The digital age has revolutionized how we manage our investments. Online brokerage platforms and mobile apps have made it easier than ever to buy, sell, and track stocks. This accessibility has fueled the growth of DIY investing and the creation of virtual stock albums that reflect individual investment goals and risk tolerance.

Building Your Own Stock Album: Strategies and Considerations

Creating a successful stock album requires careful planning and research. Here are some key considerations:

- Define Your Investment Goals: What are you hoping to achieve with your stock album? Are you saving for retirement, a down payment on a house, or another specific goal? Understanding your objectives will help you determine the appropriate risk level and investment horizon.

- Assess Your Risk Tolerance: How comfortable are you with the possibility of losing money on your investments? A conservative investor might prefer a stock album consisting of low-volatility stocks, while a more aggressive investor might be willing to take on more risk for the potential of higher returns.

- Choose Your Investment Approach: There are various approaches to building a stock album, including:

- Diversified Portfolio: Spreading your investments across different sectors and asset classes to reduce risk.

- Sector-Specific Portfolio: Focusing on a particular industry or sector that you believe has strong growth potential (e.g., technology, healthcare, renewable energy).

- Dividend-Focused Portfolio: Selecting stocks that pay regular dividends to generate income.

- Growth-Oriented Portfolio: Targeting companies with high growth potential, even if they are more volatile.

- Research Individual Stocks: Before adding a stock to your stock album, conduct thorough research on the company’s financials, business model, competitive landscape, and management team.

- Consider Exchange-Traded Funds (ETFs): ETFs are baskets of stocks that track a specific index or sector. They offer instant diversification and can be a cost-effective way to build a stock album.

The Benefits of Creating a Stock Album

A well-constructed stock album can offer several benefits:

- Potential for Capital Appreciation: Stocks have the potential to increase in value over time, providing capital gains for investors.

- Dividend Income: Some stocks pay regular dividends, which can provide a steady stream of income.

- Diversification: A stock album can help diversify your investment portfolio, reducing your overall risk.

- Control: You have direct control over the stocks in your stock album, allowing you to make investment decisions based on your own research and analysis.

- Personalization: A stock album can be tailored to your specific investment goals and risk tolerance.

The Risks of Investing in Stocks

Investing in stocks involves inherent risks:

- Market Volatility: Stock prices can fluctuate significantly due to economic conditions, company performance, and investor sentiment.

- Company-Specific Risk: The performance of individual stocks can be affected by factors specific to the company, such as management changes, product recalls, or competitive pressures.

- Loss of Capital: It is possible to lose money on your stock investments, especially if you invest in high-risk stocks or fail to diversify your portfolio.

- Inflation Risk: The purchasing power of your investments can be eroded by inflation.

- Interest Rate Risk: Changes in interest rates can affect stock prices, particularly for companies with high levels of debt.

Managing Your Stock Album: A Proactive Approach

Building a stock album is just the first step. It’s crucial to actively manage your portfolio to ensure it continues to align with your investment goals and risk tolerance. Here are some tips for managing your stock album:

- Regularly Review Your Portfolio: At least once a quarter, review your stock album to assess its performance and make any necessary adjustments.

- Rebalance Your Portfolio: Over time, the asset allocation of your stock album may drift away from your target allocation. Rebalancing involves selling some assets and buying others to restore your desired allocation.

- Stay Informed: Keep up-to-date on market news and company developments that could affect your investments.

- Consider Tax Implications: Be aware of the tax implications of buying and selling stocks, including capital gains taxes and dividend taxes.

- Seek Professional Advice: If you’re unsure about how to manage your stock album, consider seeking advice from a qualified financial advisor.

The Future of Stock Albums: Technology and Innovation

Technology is playing an increasingly important role in the world of stock albums. Robo-advisors are using algorithms to create and manage portfolios for investors based on their risk tolerance and investment goals. These automated platforms can provide personalized investment advice at a lower cost than traditional financial advisors. [See also: Robo-Advisors vs. Traditional Financial Advisors]

Furthermore, the rise of fractional shares allows investors to buy a portion of a single share of stock. This makes it easier to diversify your stock album, even with a small amount of capital. Innovation in financial technology is making stock investing more accessible and affordable for everyone.

Examples of Successful Stock Album Strategies

Let’s consider a few hypothetical examples to illustrate different stock album strategies:

Example 1: The Dividend Income Investor

This investor focuses on building a stock album of companies with a history of paying consistent and growing dividends. They might include stocks from sectors like utilities, consumer staples, and real estate investment trusts (REITs). Their goal is to generate a steady stream of income from their investments.

Example 2: The Growth Stock Enthusiast

This investor is willing to take on more risk for the potential of higher returns. Their stock album might include companies in the technology, biotechnology, and renewable energy sectors. They are looking for companies with strong growth potential, even if they are more volatile.

Example 3: The Ethical Investor

This investor wants to align their investments with their values. Their stock album might include companies that are committed to environmental sustainability, social responsibility, and good governance (ESG). They are willing to sacrifice some potential returns to invest in companies that are making a positive impact on the world.

Conclusion: Embracing the Power of the Stock Album

The concept of the stock album has evolved from a physical collection of certificates to a dynamic investment strategy. By carefully planning, researching, and managing your stock album, you can potentially achieve your financial goals and build long-term wealth. Remember to assess your risk tolerance, diversify your portfolio, and stay informed about market trends. Whether you’re a seasoned investor or just starting out, the stock album approach offers a flexible and personalized way to participate in the stock market. Always consult with a qualified financial advisor before making any investment decisions. A well-managed stock album can be a powerful tool in your financial arsenal, helping you achieve your long-term investment objectives. Investing in a stock album requires patience and discipline, but the potential rewards can be significant. The key is to stay focused on your goals and to make informed decisions based on thorough research and analysis. Remember that past performance is not necessarily indicative of future results, and it is essential to manage your expectations accordingly. Consider creating a mock stock album on paper to test different strategies before committing real capital. This will allow you to gain experience and confidence before making real investments. Finally, remember that investing is a long-term game, and it is important to stay patient and disciplined, even during market downturns. By following these guidelines, you can increase your chances of success and achieve your financial goals through a well-managed stock album.