Navigating the World of Album Stock: A Comprehensive Guide for Investors

In the dynamic landscape of financial markets, understanding the nuances of different investment vehicles is crucial for success. One such area, often overlooked but potentially lucrative, is album stock. This guide aims to provide a comprehensive overview of album stock, exploring its definition, historical context, investment strategies, risks, and potential rewards. Whether you are a seasoned investor or just starting, this article will equip you with the knowledge to make informed decisions about including album stock in your portfolio.

What Exactly is Album Stock?

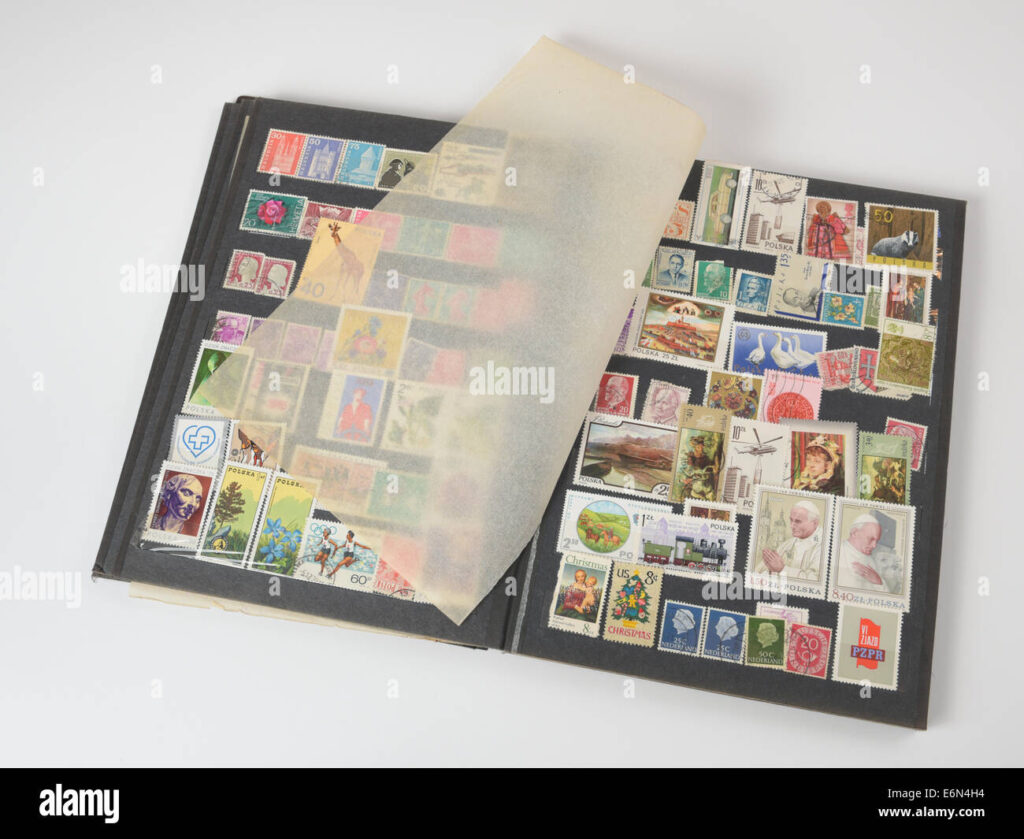

The term “album stock” doesn’t refer to shares of a company that produces music albums. Instead, it’s a niche term often used within the collectible market, specifically referring to shares or ownership stakes in collections of rare or valuable items. These collections can range from stamps and coins to sports memorabilia and, yes, even vintage music albums. The value is derived from the rarity, condition, historical significance, and market demand for the items within the collection.

Investing in album stock, in this context, means acquiring a portion of the ownership of a curated collection. This can be done through direct purchase of shares in a collection offered by a specialized firm or, less commonly, by investing in funds that specialize in acquiring and managing such collections. The appeal lies in the potential for appreciation as the value of the underlying collectibles increases over time.

A Brief History of Collectibles Investing

The concept of investing in collectibles is not new. Throughout history, people have sought to preserve wealth and generate returns by acquiring rare and valuable objects. From ancient artifacts to Renaissance art, collectibles have served as both stores of value and sources of prestige. The modern era has seen the rise of organized markets for collectibles, facilitated by auction houses, online marketplaces, and specialized investment firms. The rise of fractional ownership platforms has also made it easier for a wider range of investors to participate in this market.

Album stock, as a specific niche within collectibles investing, has emerged as a way to diversify portfolios and tap into the passion and demand for tangible assets. While it shares similarities with other collectibles investments, such as art or wine, it also presents unique challenges and opportunities.

Investment Strategies Involving Album Stock

Several strategies can be employed when considering album stock investments:

- Direct Investment: This involves purchasing shares in a specific collection of rare albums or other collectibles. Due diligence is paramount here, as the value is tied directly to the quality and marketability of the items in the collection.

- Fund Investment: Some investment firms specialize in acquiring and managing collections of rare items. Investing in these funds provides diversification across multiple collections, mitigating some of the risk associated with individual item valuations.

- Fractional Ownership Platforms: These platforms allow investors to purchase small fractions of valuable assets, including rare albums and other collectibles. This lowers the barrier to entry and allows for portfolio diversification across a range of assets.

- Self-Curated Collection: While not strictly “album stock” in the formal sense, building your own collection of rare or valuable albums can be a form of investment. This requires significant expertise and time but can yield substantial returns if done correctly.

Risks Associated with Album Stock Investments

Investing in album stock, like any investment, carries inherent risks that investors must carefully consider:

- Valuation Risk: Determining the fair market value of rare collectibles can be subjective and challenging. Market trends, condition assessment, and authenticity verification all play a role, and errors in any of these areas can lead to overvaluation.

- Liquidity Risk: The market for rare collectibles can be illiquid, meaning it may be difficult to quickly sell your shares at a desirable price. This is particularly true for niche or specialized collections.

- Storage and Insurance Costs: Proper storage and insurance are essential for protecting the value of the underlying collectibles. These costs can eat into potential returns.

- Fraud and Counterfeiting: The market for rare collectibles is susceptible to fraud and counterfeiting. Investors must be vigilant in verifying the authenticity and provenance of the items in a collection.

- Market Sentiment: Like any asset class, the value of collectibles can be influenced by market sentiment and economic conditions. Demand for certain types of collectibles may fluctuate over time.

Potential Rewards of Investing in Album Stock

Despite the risks, album stock investments can offer several potential rewards:

- Appreciation Potential: Rare and well-preserved collectibles can appreciate significantly in value over time, offering the potential for substantial returns.

- Diversification: Collectibles can offer diversification benefits to a portfolio, as their performance is often uncorrelated with traditional asset classes like stocks and bonds.

- Passion Investing: For collectors and enthusiasts, investing in album stock can be a way to combine financial goals with personal interests.

- Tangible Asset: Unlike stocks or bonds, collectibles are tangible assets that can be physically held and enjoyed.

- Inflation Hedge: Historically, certain collectibles have served as a hedge against inflation, as their value tends to rise during periods of rising prices.

Due Diligence: The Key to Success

Before investing in album stock, thorough due diligence is essential. This includes:

- Researching the Collection: Understand the history, provenance, and condition of the items in the collection. Consult with experts and obtain independent appraisals.

- Evaluating the Management Team: If investing in a fund or through a platform, assess the experience and track record of the management team.

- Understanding the Fee Structure: Be aware of all fees associated with the investment, including management fees, storage costs, and insurance premiums.

- Reviewing Legal Documents: Carefully review all legal documents, including the prospectus, offering memorandum, and subscription agreement.

- Assessing Your Risk Tolerance: Album stock investments can be volatile and illiquid. Make sure you are comfortable with the level of risk involved.

The Future of Album Stock Investing

The market for album stock is evolving, driven by factors such as the increasing demand for alternative investments, the rise of fractional ownership platforms, and the growing accessibility of online marketplaces. As technology continues to disrupt the financial industry, we can expect to see further innovation and increased participation in the collectibles market. However, it’s crucial to remember that this market is still relatively niche and requires careful consideration and due diligence.

Conclusion

Album stock offers a unique opportunity to diversify portfolios and tap into the passion and demand for rare and valuable collectibles. However, it also presents significant risks that investors must carefully consider. By conducting thorough due diligence, understanding the market dynamics, and assessing your risk tolerance, you can make informed decisions about whether album stock is the right investment for you. Remember to consult with a qualified financial advisor before making any investment decisions. Investing in album stock requires a blend of financial acumen and a genuine appreciation for the underlying collectibles. With careful planning and execution, it can be a rewarding and potentially lucrative addition to your investment strategy. [See also: Investing in Rare Collectibles] [See also: Understanding Alternative Investments] [See also: Risk Management for Investors]