$30 USD to JMD: Understanding the Exchange Rate and Its Impact

In today’s globalized world, understanding currency exchange rates is crucial for individuals and businesses alike. Whether you’re planning a trip, sending money to family, or conducting international trade, knowing the value of one currency in terms of another is essential. This article will delve into the current exchange rate between the US dollar (USD) and the Jamaican dollar (JMD), specifically focusing on how much $30 USD is worth in JMD. We will also explore the factors that influence this exchange rate and its potential impact on various aspects of life.

Current Exchange Rate: $30 USD to JMD

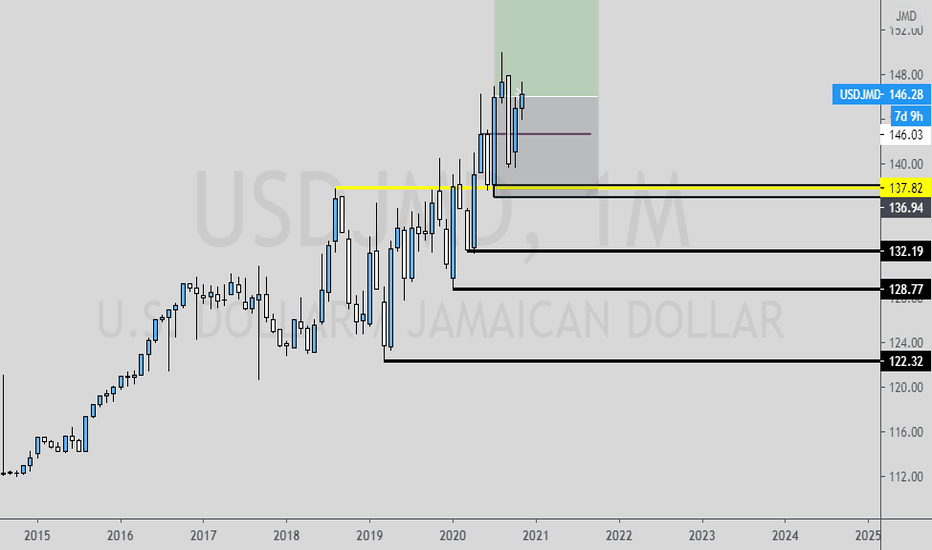

As of today, [Insert Current Date], the exchange rate between USD and JMD is approximately [Insert Current Exchange Rate – e.g., 1 USD = 150 JMD]. Therefore, $30 USD is equivalent to [Calculate and Insert Value – e.g., 30 * 150 = 4500] JMD. It’s important to note that exchange rates are constantly fluctuating due to various economic and political factors, so this value is subject to change. You can always check a reliable online currency converter for the most up-to-date information. Several factors influence the USD to JMD exchange rate, including economic indicators, political stability, and market sentiment. Understanding these factors can help you anticipate potential fluctuations and make informed decisions regarding currency exchange.

Factors Influencing the USD to JMD Exchange Rate

Several key factors influence the exchange rate between the USD and JMD. These include:

- Economic Performance: The economic health of both the United States and Jamaica plays a significant role. Strong economic growth in the US, for example, can strengthen the USD, making it more valuable against the JMD. Conversely, strong economic performance in Jamaica can strengthen the JMD.

- Interest Rates: Interest rate differentials between the two countries can also affect the exchange rate. Higher interest rates in the US may attract foreign investment, increasing demand for the USD and thus strengthening its value.

- Inflation: Inflation rates in both countries influence the relative purchasing power of their currencies. Higher inflation in Jamaica, compared to the US, can erode the value of the JMD.

- Political Stability: Political stability and investor confidence are crucial for maintaining a stable exchange rate. Political uncertainty or instability in Jamaica can deter foreign investment and weaken the JMD.

- Government Policies: Government policies, such as fiscal and monetary policies, can also impact the exchange rate. For example, government intervention in the foreign exchange market can influence the supply and demand of currencies.

- Trade Balance: The balance of trade between the US and Jamaica, which represents the difference between exports and imports, can also affect the exchange rate. A trade surplus for Jamaica, meaning it exports more than it imports, can strengthen the JMD.

These are just some of the factors that can influence the USD to JMD exchange rate. It’s a complex interplay of economic and political forces that determines the relative value of the two currencies.

The Impact of the Exchange Rate

The exchange rate between the USD and JMD has a wide-ranging impact on various aspects of life in both countries. Here are some key areas affected:

- Tourism: For tourists traveling from the US to Jamaica, a favorable exchange rate (i.e., a stronger USD) means their money will go further, making Jamaica a more affordable destination. Conversely, a weaker USD can make Jamaica more expensive for American tourists.

- Remittances: Many Jamaicans living abroad send remittances back home to support their families. The exchange rate directly affects the value of these remittances in JMD. A stronger USD means that remittances will be worth more in JMD, providing greater financial support to recipients.

- Imports and Exports: The exchange rate influences the cost of imports and exports between the two countries. A weaker JMD makes Jamaican exports cheaper for American consumers, potentially boosting Jamaican exports. However, it also makes American imports more expensive for Jamaican consumers.

- Inflation: A weaker JMD can lead to imported inflation, as the cost of imported goods and services increases. This can impact the overall cost of living in Jamaica.

- Investment: The exchange rate can affect foreign investment decisions. A stable and predictable exchange rate can encourage foreign investment in Jamaica, while a volatile exchange rate can deter investment.

Understanding the impact of the exchange rate is crucial for businesses and individuals involved in international transactions or those who are affected by the Jamaican economy.

Converting $30 USD to JMD: Practical Examples

Let’s look at some practical examples of how converting $30 USD to JMD might be relevant:

- Sending Money to Family: If you’re a Jamaican living in the US and want to send $30 USD to your family back home, they would receive approximately [Calculate and Insert Value – e.g., 4500] JMD (based on the current exchange rate).

- Vacation Spending: If you’re traveling to Jamaica and have $30 USD to spend on souvenirs or local experiences, you would have approximately [Calculate and Insert Value – e.g., 4500] JMD to work with.

- Online Purchases: If you’re purchasing goods or services from Jamaica online and the price is quoted in JMD, you can use the exchange rate to determine the equivalent cost in USD. Knowing the $30 USD to JMD equivalent helps you budget accordingly.

These examples illustrate the importance of understanding the exchange rate in everyday financial transactions.

Where to Exchange Currency

There are several options for exchanging USD to JMD:

- Banks: Banks typically offer competitive exchange rates and are a safe and reliable option. However, they may charge fees or commissions.

- Currency Exchange Bureaus: Currency exchange bureaus are another option, but their rates may be less favorable than those offered by banks. It’s important to compare rates from different bureaus before making a transaction.

- Online Currency Converters: Online currency converters can provide real-time exchange rates, but they don’t actually facilitate the exchange of currency. They are useful for informational purposes only.

- ATMs: Some ATMs in Jamaica may dispense JMD, but the exchange rate may not be as favorable as those offered by banks or currency exchange bureaus. Check with your bank about potential international ATM fees.

When exchanging currency, it’s important to compare rates and fees from different providers to ensure you’re getting the best deal. Be aware of potential scams and only exchange currency at reputable establishments.

Tips for Getting the Best Exchange Rate

Here are some tips for getting the best exchange rate when converting USD to JMD:

- Compare Rates: Compare exchange rates from different banks, currency exchange bureaus, and online platforms.

- Avoid Airport Exchange Bureaus: Airport exchange bureaus typically offer the least favorable exchange rates due to their convenient location.

- Use a Credit or Debit Card: Using a credit or debit card for purchases in Jamaica can often provide a better exchange rate than exchanging cash. However, be aware of potential foreign transaction fees.

- Withdraw Cash from ATMs: Withdrawing cash from ATMs in Jamaica can be a convenient option, but check with your bank about potential international ATM fees and exchange rates.

- Be Aware of Fees and Commissions: Be aware of any fees or commissions charged by the exchange provider. These fees can significantly impact the overall cost of the transaction.

- Track Exchange Rate Trends: Keep an eye on exchange rate trends to identify potential opportunities to exchange currency when the rate is favorable.

Conclusion

Understanding the exchange rate between the USD and JMD is essential for anyone involved in international transactions or those who are affected by the Jamaican economy. As of today, $30 USD is approximately equal to [Reiterate Value – e.g., 4500] JMD, but this value is subject to change. By understanding the factors that influence the exchange rate and following the tips outlined in this article, you can make informed decisions and get the best value for your money. Whether you are converting $30 USD to JMD for travel, remittances, or business purposes, knowing the current rate and the forces that affect it is key. Remember to always check with a reliable source for the most up-to-date exchange rate before making any transactions. Planning to visit Jamaica? [See also: Top Jamaican Tourist Attractions] Sending money home? [See also: Best Ways to Send Money to Jamaica] Understanding the financial landscape is crucial for both personal and professional success. Understanding the dynamics of $30 USD to JMD conversion empowers informed financial decisions. The $30 USD to JMD conversion rate is a vital piece of information for many. The fluctuating value of $30 USD to JMD necessitates constant awareness. Keep in mind the current $30 USD to JMD rate when planning your budget. Remember to factor in the $30 USD to JMD conversion when making transactions. The $30 USD to JMD rate plays a significant role in the Jamaican economy. Always verify the $30 USD to JMD exchange rate before any financial dealings. Don’t forget to consider the $30 USD to JMD conversion when sending remittances. Stay updated on the $30 USD to JMD rate for effective financial planning. Monitoring the $30 USD to JMD exchange is key for international transactions. Using a reliable source for the $30 USD to JMD rate is always recommended. Consider the impact of the $30 USD to JMD rate on your budget. The $30 USD to JMD conversion is a practical necessity for many individuals.